nj property tax relief 2018

3 rows If your 2018 New Jersey Gross Income is. More than 600000 lower- and.

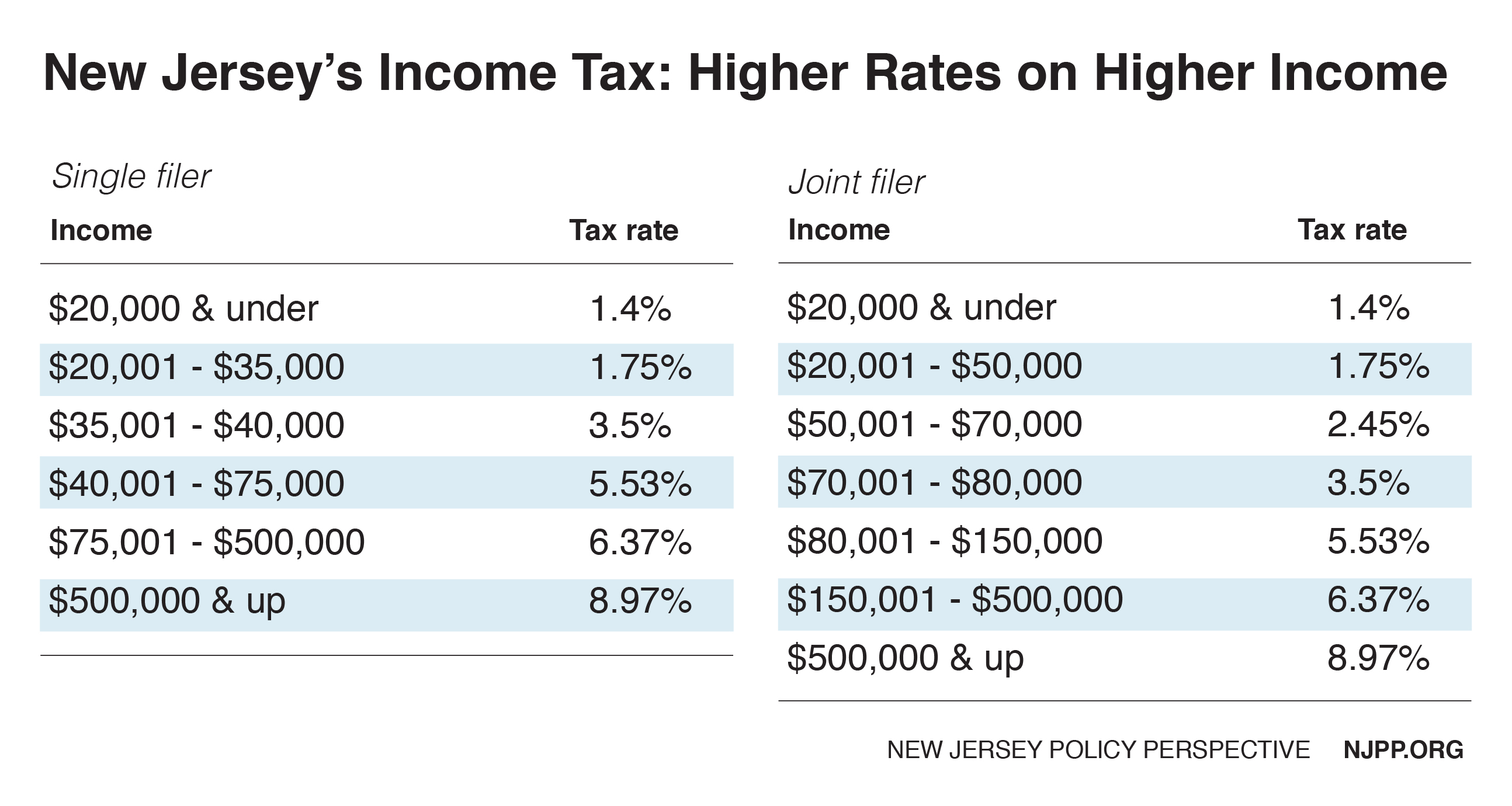

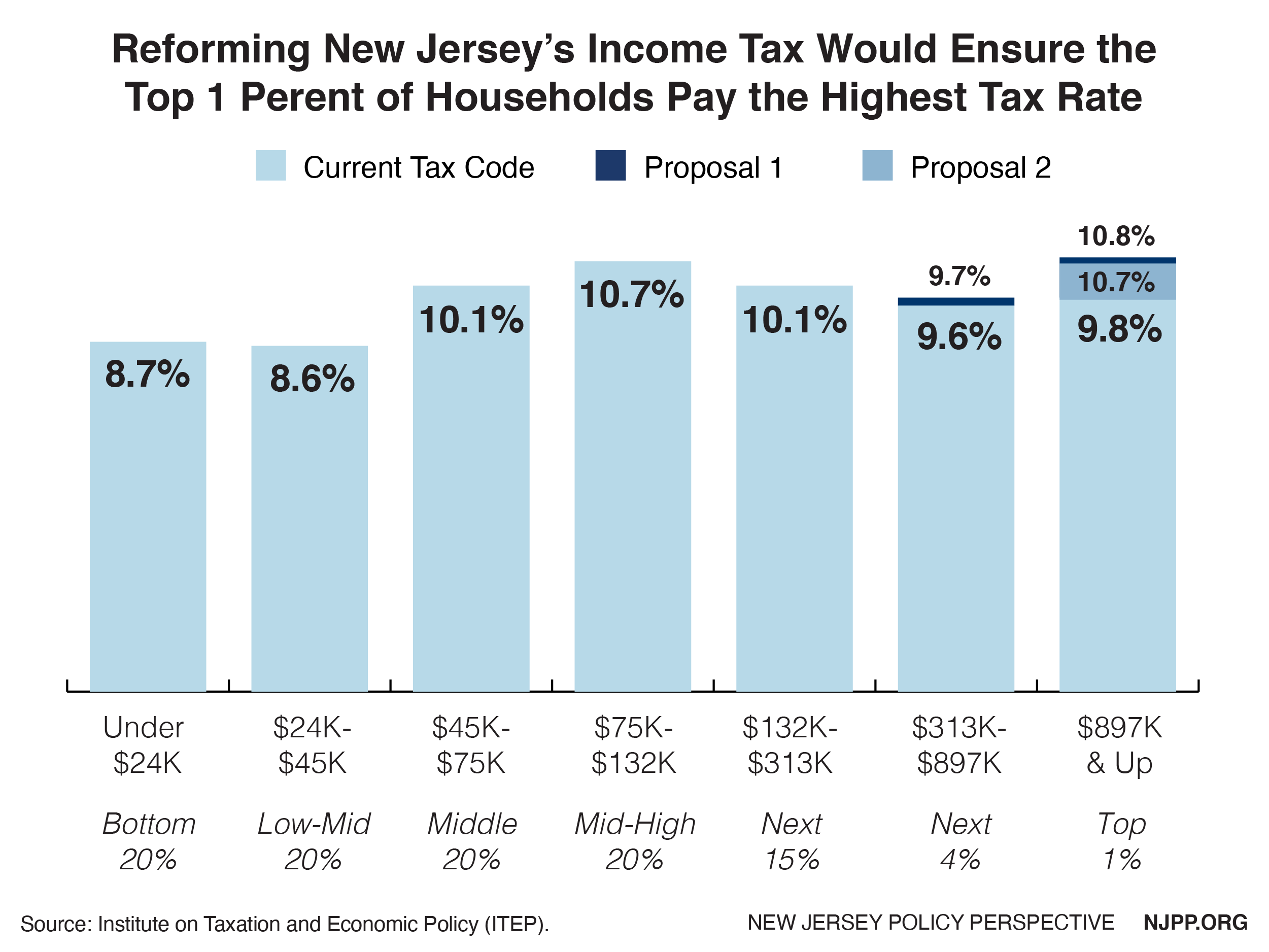

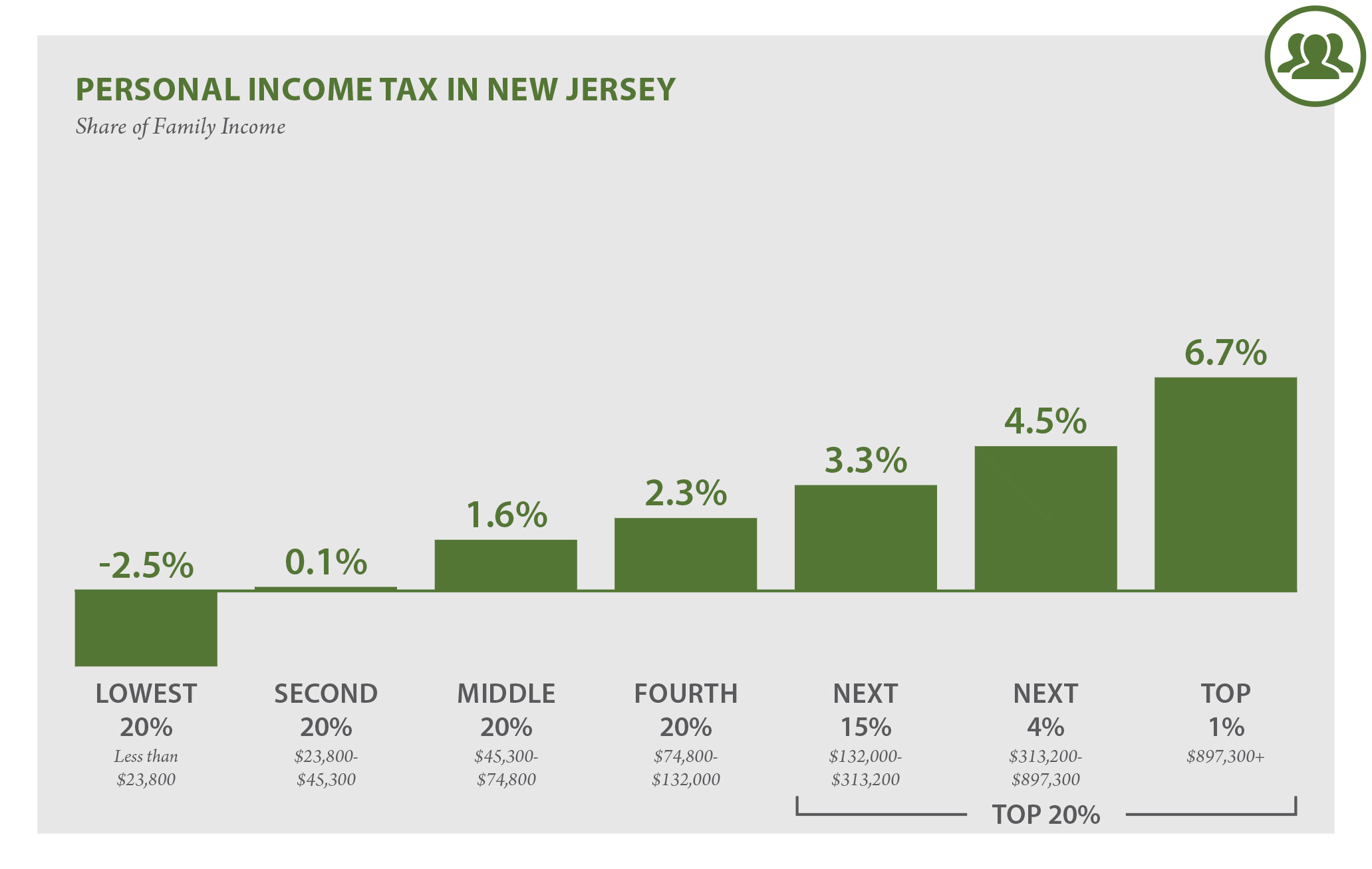

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

New Jersey Governor Murphy froze the May 1 2020 Homestead Benefit Program payment in the midst of the COVID-19 pandemic and.

. All property tax relief program information provided here is based on current law and is subject to change. And checks averaging 219 for 25100 expected. 2018 New Jersey gross income.

The New Jersey Homestead Benefit Program provides property tax relief to eligible homeowners in the form of a property tax credit that the state pays to municipalities on. Same old end run. Thats projected to be enough money to cover reimbursement checks averaging 1401 for an estimated 138200 existing senior-freeze recipients.

2018 filing status single. Which is dedicated to the Property Tax Relief Fund is up 94 percent year-to-date in FY 2018 1125 billion above the same point last year. Earlier this year NJ Spotlight News detailed how Murphys first draft of the fiscal year 2022 spending plan called for continuing the practice of inserting technical language into the annual budget to keep property-tax bills from.

That policy change came around the same time President Donald. How Homestead Benefits Are Paid. 2018 Homestead Benefit payments should be paid to eligible taxpayers beginning in May 2022.

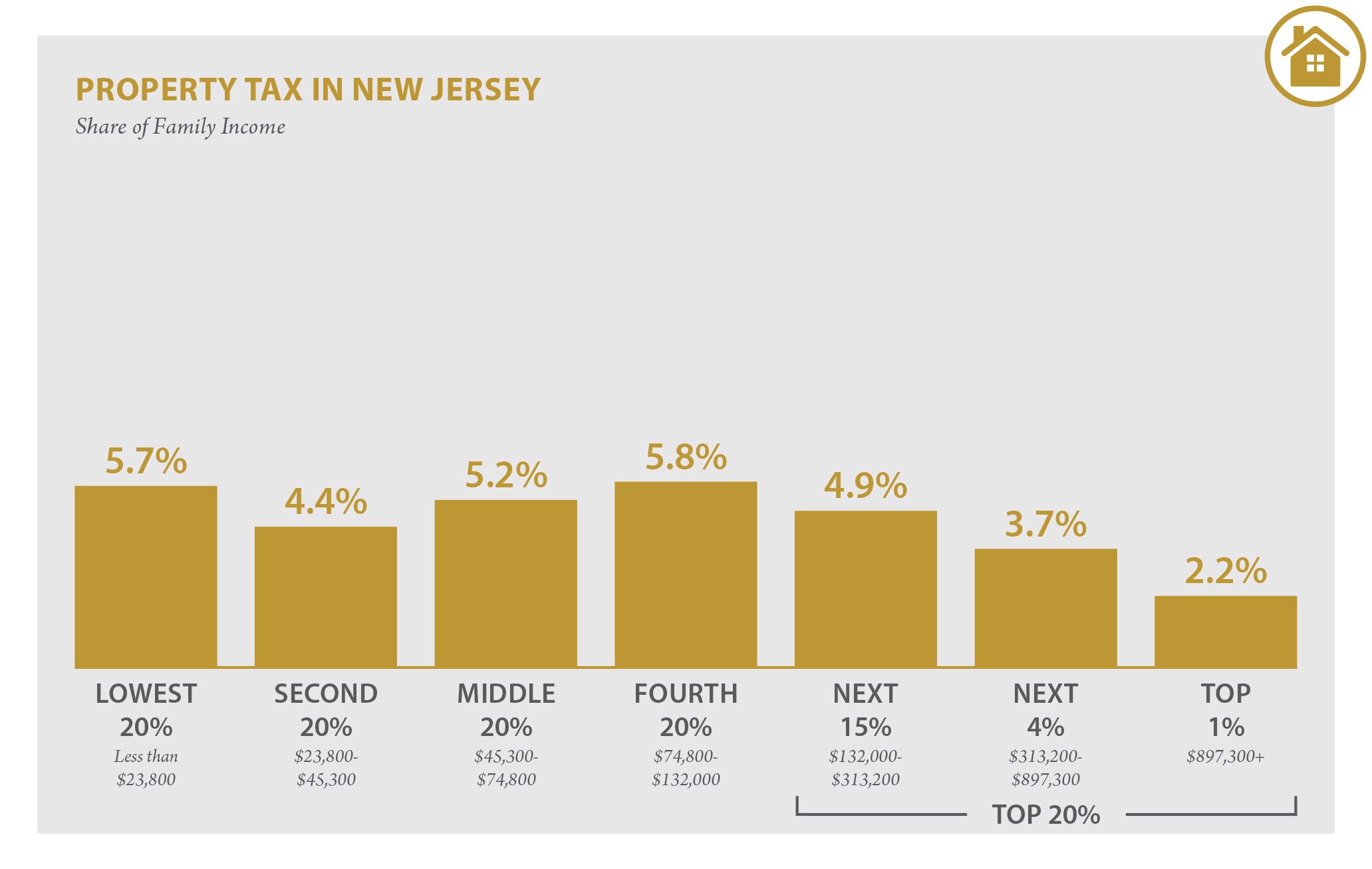

Property taxes for 2018 were paid on that home. The property-tax write-off is offered to homeowners and also some tenants regardless of their annual income and the biggest tax breaks typically go to those with the biggest property tax bills. Property Tax Relief Programs.

Property Tax Relief Programs. Murphy expanded the cap on the tax deduction in 2018 lifting it from 10000 to 15000. The deadline to file the application is October 31 2022.

Rate Reduction The New Jersey Sales and Use Tax is being reduced in two phases between 2017 and 2018. New Jerseys Property Tax Relief Programs Joyce Olshansky Team Leader. Forms are sent out by the State in late Februaryearly March.

MoreWith 6 months down Gov. The New Jersey tax credit is a percentage of the taxpayers federal child and dependent care credit. All property tax relief program information provided here is based on current law and is subject to change.

New Jersey Governor Murphy froze the May 1 2020 Homestead Benefit Program payment in the midst of the COVID-19 pandemic and then cut the program by 142 million. For most homeowners the benefit is distributed to your municipality in the form of a credit which reduces your property taxes. The total amount of all property tax relief benefits you receive Homestead Benefit Senior Freeze Property Tax Deduction for senior citizensdisabled persons and Property Tax Deduction for veterans cannot be more than the.

October 31 2018 Reimbursement Checks. Between May 2. Enacted in July 2018 increases the maximum Property Tax Deduction from 10000 to 15000.

The 2021 property tax credits are based on ones 2017 income and property taxes paid. Homestead tax credits and rebates will generally be about half of what they were in 2017. Under New Jersey law if you owe money to New Jersey any of its agencies or the Internal Revenue.

The state of New Jerseys official Department of the Treasury Web site is the gateway to NJ Treasury information and services for residents. The Homestead Benefit program provides property tax relief to eligible homeowners. The amount appropriated for property tax relief programs in the State Budget does not include funding for 2018 tenant rebates.

Income Tax refunds New Jersey federal and other jurisdictions. On January 1 2017 the tax rate decreased from 7 to 6875. How Homestead Benefits Are Paid 2018 Homestead Benefit.

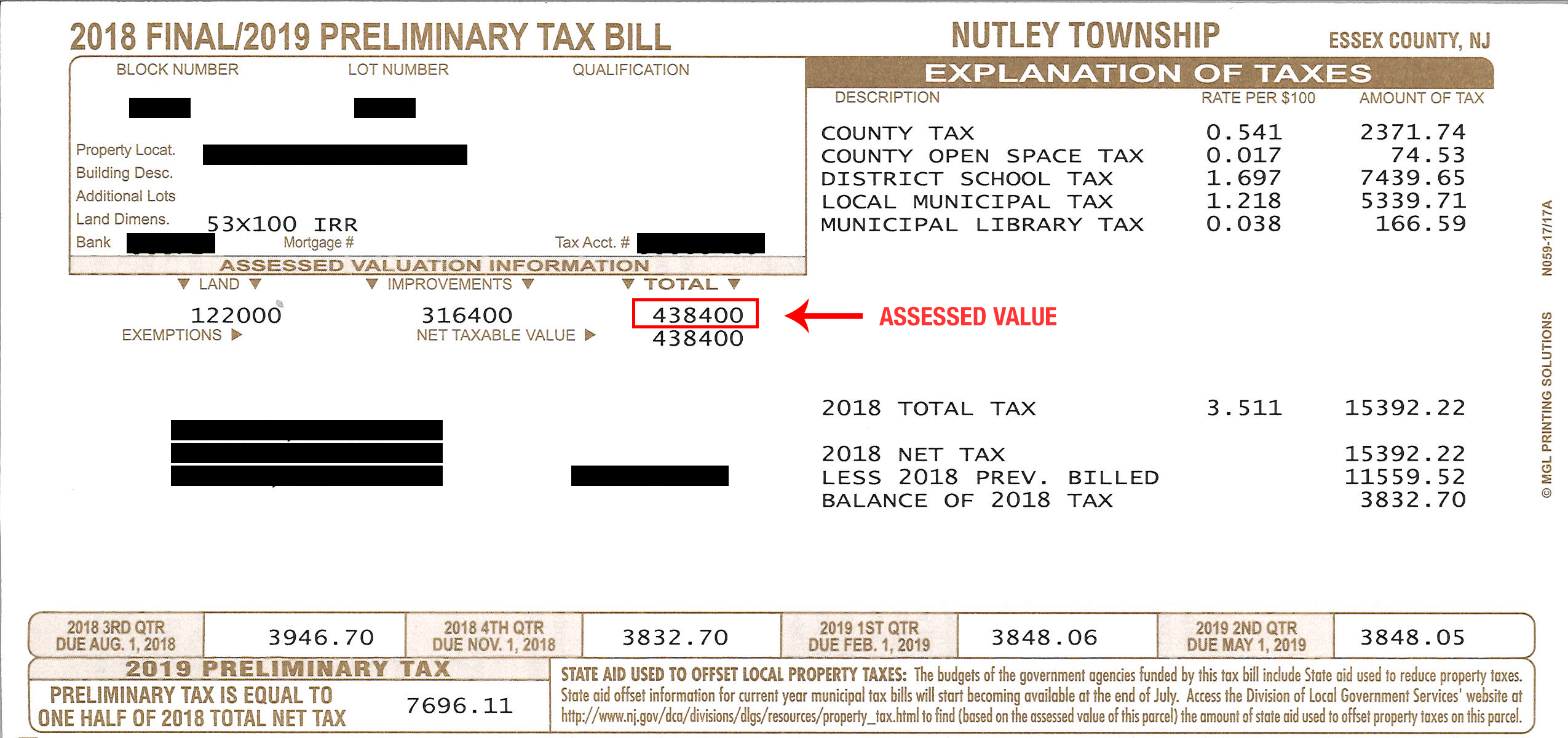

Nj Property Tax Relief Program Updates Access Wealth Township Of Nutley New Jersey Property Tax Calculator Pin On From Our Blog How To Appeal Property Taxes And Win Over The Appraiser We Did Nj Com. The latest round of benefits scheduled to be paid in May 2022 are intended to offset the property-tax bills from 2018. We will begin mailing 2021 applications in early March 2022.

Stay up to date on vaccine information. Additional information on the Sales and Use Tax changes is available online. Check Issued on or Before.

The amount varies according to the amount of the taxpayers NJ taxable income. For residents who did not receive a prior years reimbursement or Form PTR-2 for residents who did. Before May 1 2018.

All Property Tax Relief Benefits are Subject to Change NJ FY 2019 Budget Passed July 1 2018. June will be the 12th month of FY 2018 featuring. When Did You Send Your Application.

Murphy still learning how to win friends and influence lawmakers OpinionTax relief better be on the horizon if Phil Murphy wants to get re-elected. If you owned more than one property in New Jersey only file the application for the property that was your principal residence on October 1 2018. Able to locate your 2017 and 2018 property tax bills or proof of the amount of taxes paid.

On January 1 2018 and after the tax rate will decrease to 6625. Senior Freeze Property Tax Reimbursement Program. The extended filing date for the 2018 New Jersey Corporation Business Tax Return on October 15 2019 is the same due date as the federal return.

And Murphys budget for the fiscal year that begins July 1 doesnt include enough cash. The State of New Jersey has provided a web page for residents to access information about property tax relief. 2021 Senior Freeze Applications.

Seniors in garden Many New Jersey homeowners are facing increased property tax bills this spring after the state Legislature cut the Homestead tax-relief program during last years budget battle between lawmakers and former Gov. Credit on Property Tax Bill. For information call 800-882-6597 or to visit the NJ Division of Taxation website for information and downloadable forms.

The program was restored in the approved budget that went into effect on October 1 2020. Earlier this month Christie signed into law a 347 billion budget for the 2018 fiscal year that included 200 million for the senior-freeze program. However the total of all property tax relief benefits that you receive for 2018 Senior Freeze Homestead Benefit Property Tax Deduction for.

COVID-19 is still active. To put this in perspective the average NJ citizen paid approximately 8861 in. Call NJPIES Call Center.

NJ Division of Taxation - Local Property Tax Relief Programs. Property Tax Relief Programs Homestead Benefit. One of New Jerseys top property tax relief.

A property tax relief cut equates to a property tax increase and real people pay the price - by being driven from their homes by having to choose between paying their taxes and other vital needs. Nj property tax relief 2018 Monday May 23 2022 Edit. Phil Murphy has unveiled a property tax relief plan for nearly 18 million state residents for fiscal year 2023.

Nj property tax relief 2018 Thursday March 17 2022 Edit.

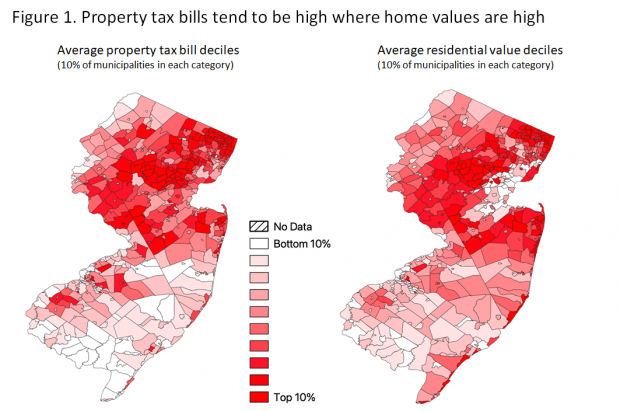

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

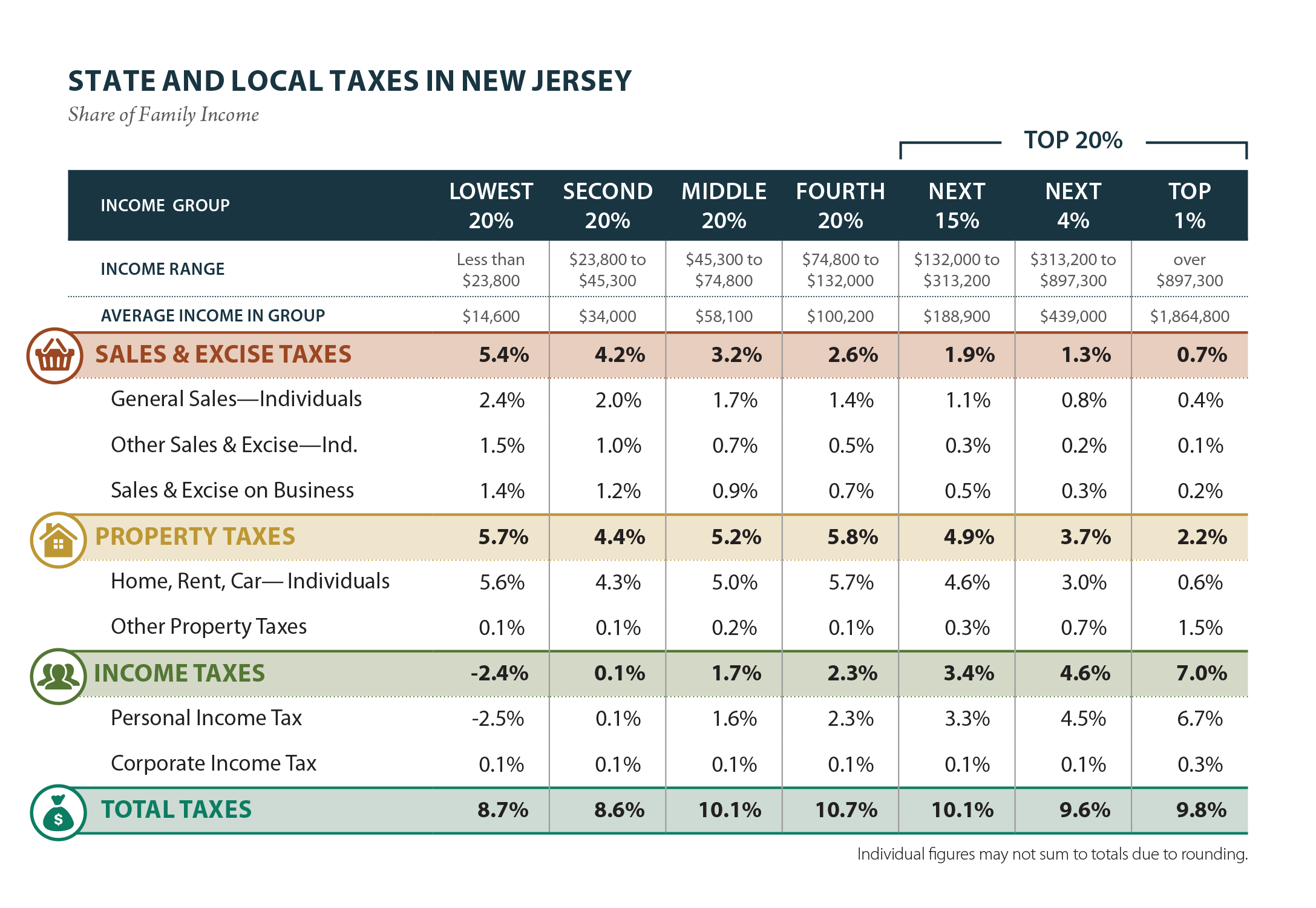

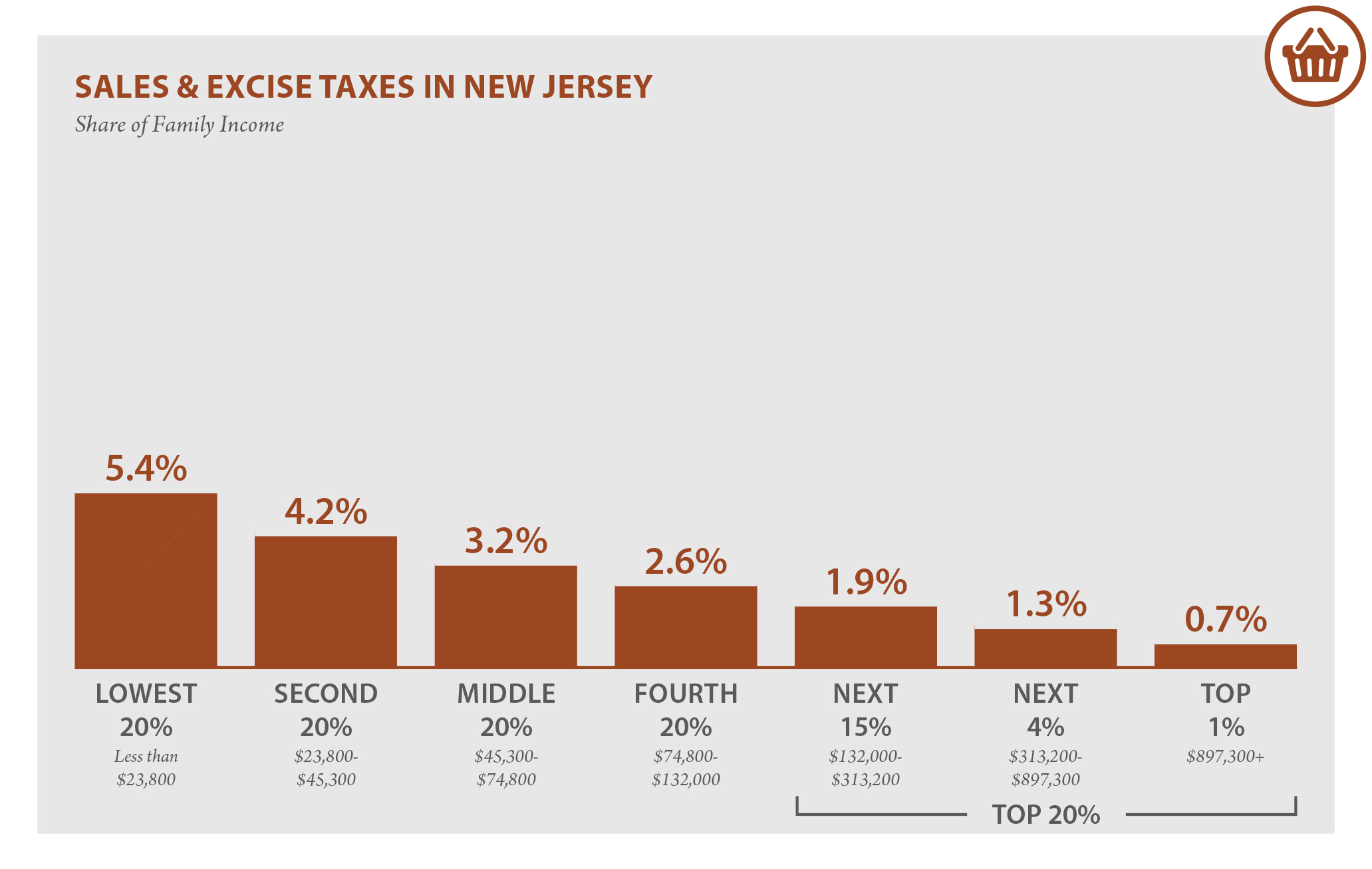

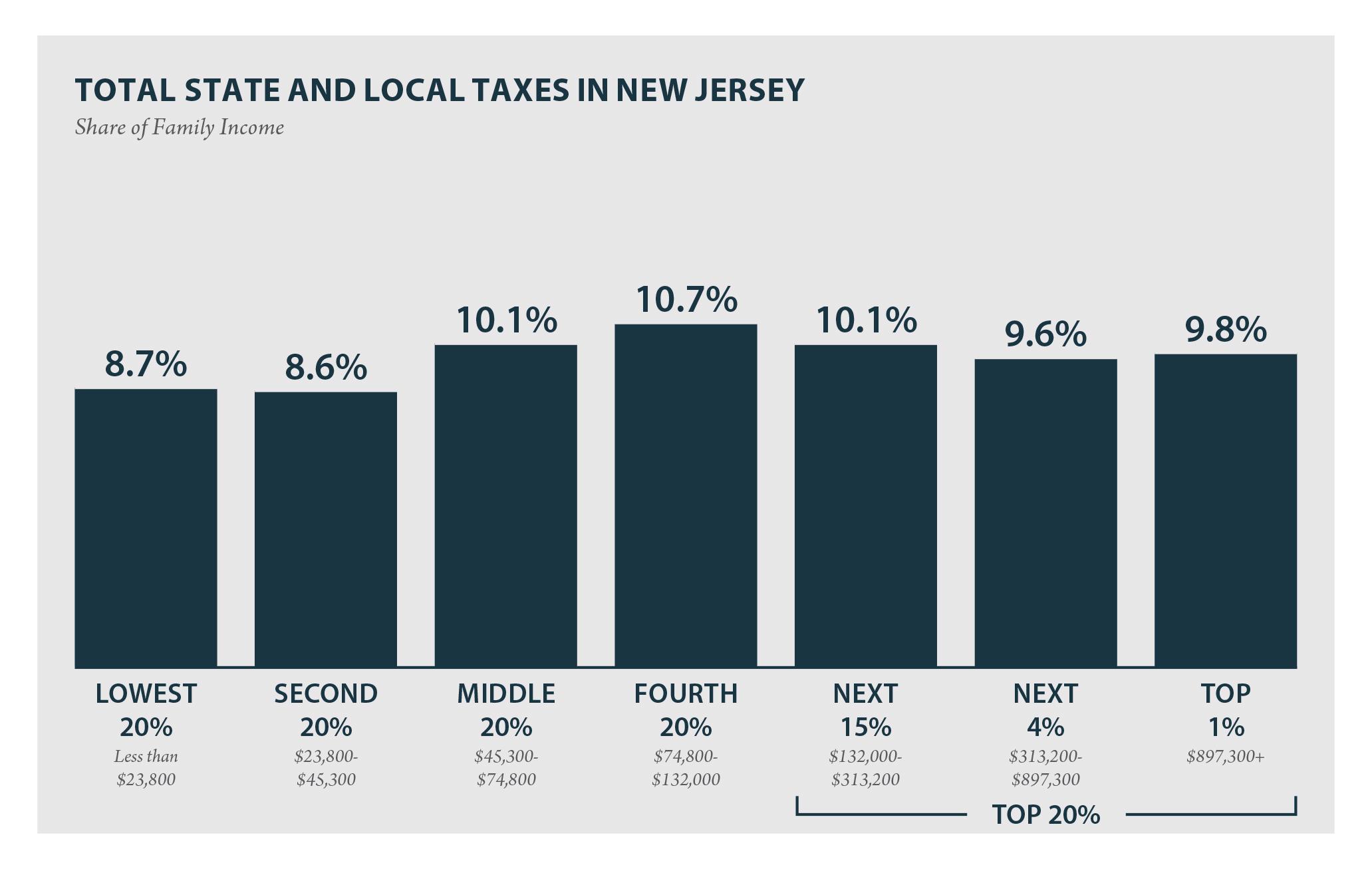

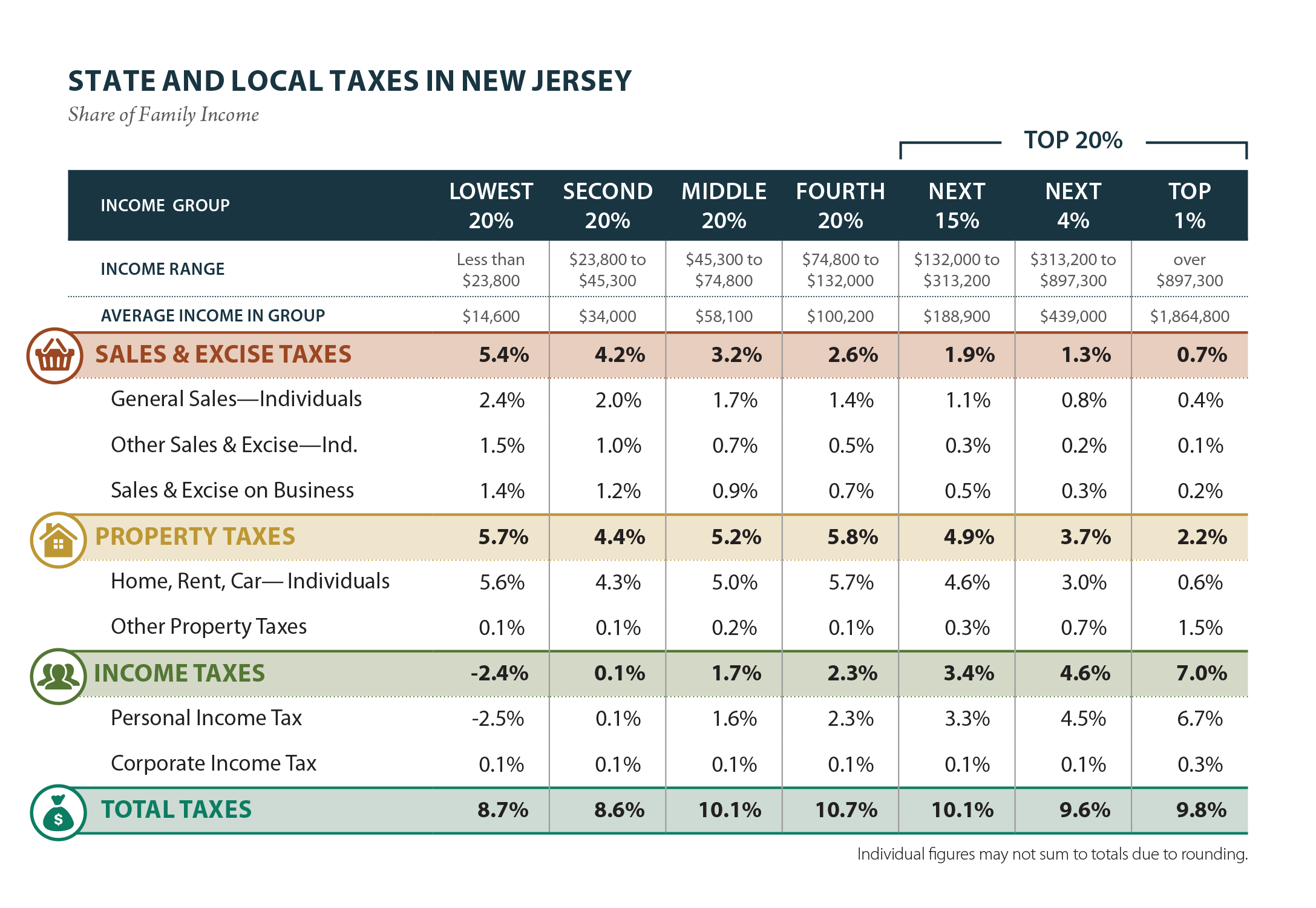

New Jersey Who Pays 6th Edition Itep

Phil Murphy Agrees To Reduced Sales Tax In These 5 N J Cities Nj Com

New Jersey Who Pays 6th Edition Itep

Just A Reminder It Is That Time Of Year To File Your Homestead Exemption Here Is The Information Hope You Have A Great Selling House Just A Reminder Reminder

Township Of Nutley New Jersey Property Tax Calculator

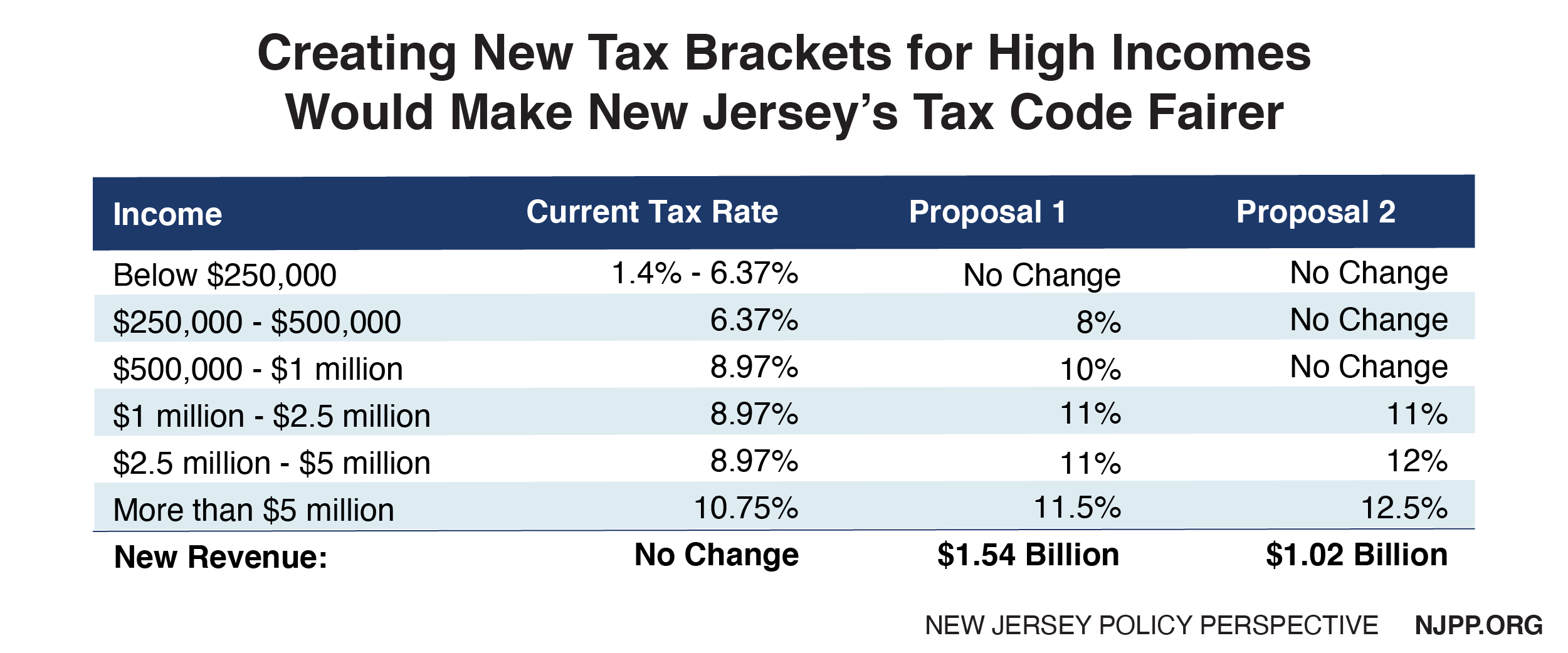

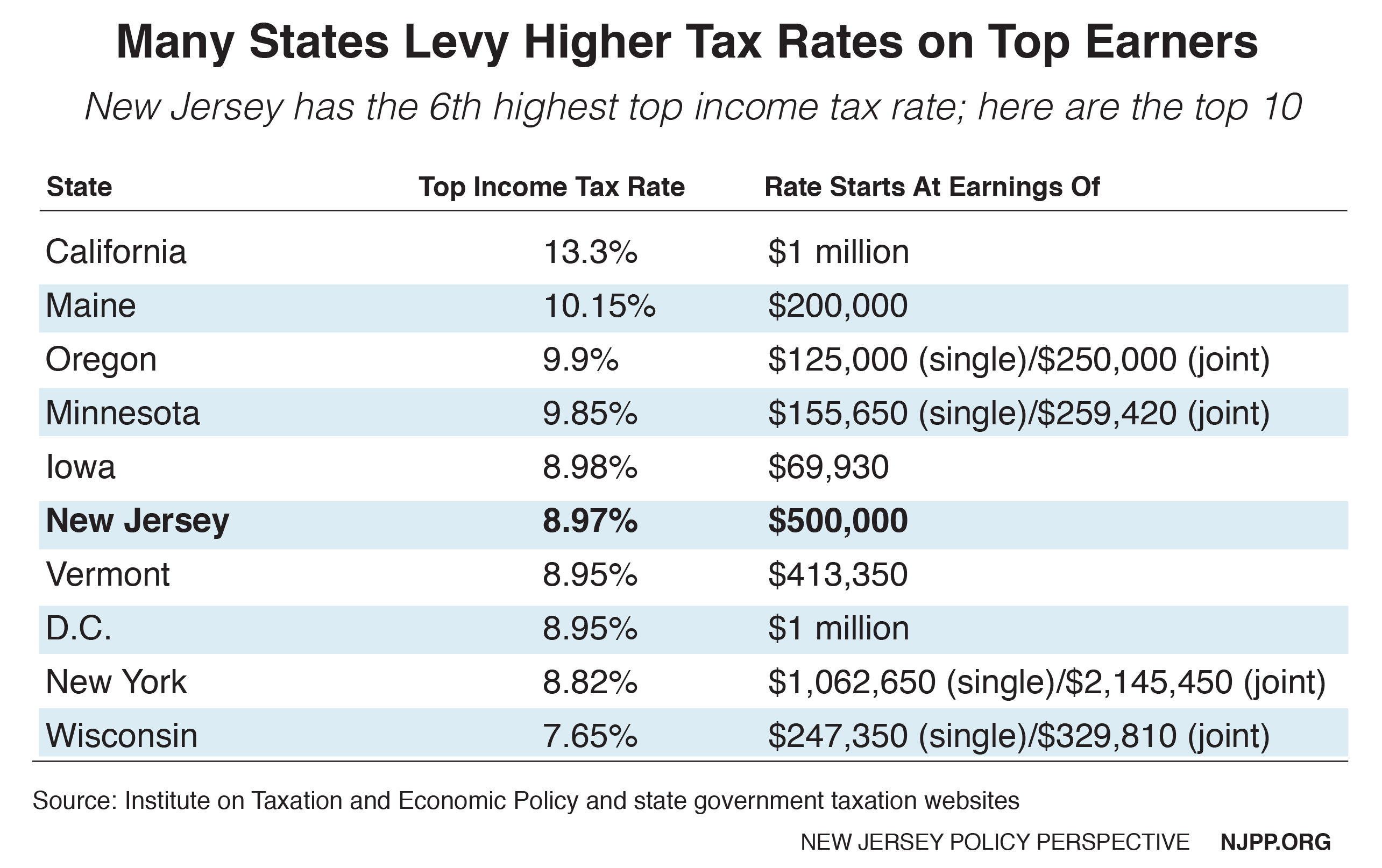

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

Where S My New Jersey State Tax Refund Taxact Blog

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

New Jersey Who Pays 6th Edition Itep

Just A Reminder It Is That Time Of Year To File Your Homestead Exemption Here Is The Information Hope You Have A Great Selling House Just A Reminder Reminder

New Jersey Who Pays 6th Edition Itep

New Jersey Who Pays 6th Edition Itep

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Nj Property Tax Relief Program Updates Access Wealth

The Top Ten Events In Somerset County Nj This Weekend March 30 April 1 2018 Joe Peters Somerset County Somerset County

Property Tax Reduction Should You Hire An Expert Tax Reduction Property Tax Tax Consulting